Waterstones Sees Fourfold Profit Surge as Employees Return to Workspaces

The reopening of offices throughout Britain has significantly contributed to a nearly fourfold increase in profits for the country’s largest bookseller over the past year.

According to recently submitted financial documents with Companies House, Waterstones reported a pre-tax profit jump from £11.2 million to £42.9 million for the year ending April 27. Sales figures also rose from £452.4 million to £528.3 million.

The retailer, which owns Blackwell’s and Foyles, noted that sales experienced a boost due to “encouraging growth in London and other major city centers, spurred by rising tourist numbers and the return of office workers.”

The trend of returning to the office—where employees gradually resume their roles in physical workspaces post-pandemic—has gained renewed attention, particularly after the advertising giant WPP faced backlash for mandating a four-day in-office work schedule for its employees.

Lord Rose of Monewden, who previously led Marks & Spencer and Asda, recently commented that working from home has resulted in a workforce that is “not doing proper work.”

Waterstones is not alone in moving towards in-office requirements, as other major companies such as Amazon, Boots, and JP Morgan have implemented policies requiring their headquarter staff to be present every day.

This resurgence in profitability at Waterstones follows a drastic 78 percent decline in profits the previous year, which was attributed to technical problems at its warehouse leading to order backlogs.

The business, now owned by Elliott Advisors, reported that profitability has improved due to reduced costs related to “system implementation,” offset by the pressure of rising operational expenses due to inflation.

Further, the retailer highlighted the increased interest in both reading and brick-and-mortar bookshops, significantly bolstered by social media and favorable media coverage.

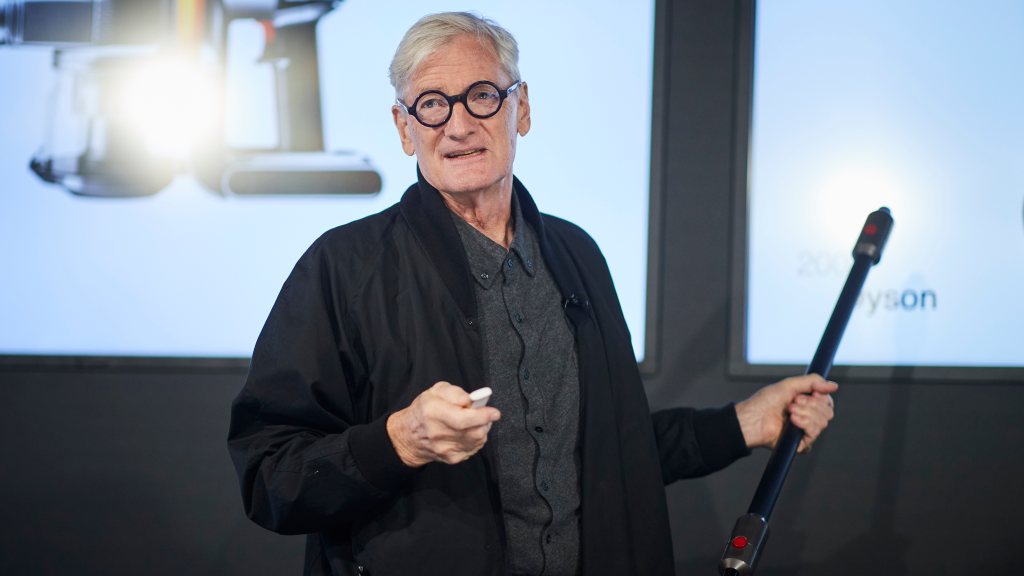

James Daunt, who has served as chief executive of Waterstones since 2011, announced plans to open numerous new bookshops across the UK this year. He also alluded to a potential stock market flotation, either in London or New York, during a recent interview with the Financial Times.

Founded in 1982 by Tim Waterstone after receiving a £6,000 redundancy payment from WH Smith, the company underwent various ownership changes before being acquired by Elliott in 2018. Waterstones currently operates over 300 bookshops across the UK, Ireland, the Netherlands, and Belgium.

As part of a strategy to streamline intercompany balances, the latest accounts indicate that a £71 million capital reduction occurred in April, followed by a declared dividend of £72.9 million.

This dividend was utilized to alleviate an intercompany receivable owed from Waterstones’ immediate parent, Book Retail Bidco, which is entirely owned by Elliott.

Further information regarding the dividend payment was requested from both Elliott and Waterstones.

Post Comment