ust-74.ru

Overview

How Should I Be Investing Right Now

When markets are going up, putting your money to work right away takes full advantage of market growth. If you are overwhelmed, start small. Right now, in your 20s, you have time on your side to create positive financial habits and potentially compounded wealth. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also. The same advice goes for any other high interest debt (about 8% or above) which does not offer the tax advantages of, for example, a mortgage. Now, once you. If you're young and investing long term, stock indexes. Picking stocks is hard, though more sensible than crypto. Short term? CDs or t-bill ladders? Investing in stocks, bonds and mutual funds offers the potential to grow your investment faster than a simple savings account. Stick with Your Plan: Buy Low, Sell High -- Shifting money away from an asset category when it is doing well in favor an asset category that is doing poorly may. The macro backdrop: Resilient growth, fading inflation · Inflation is falling while the labor market is solid and growth is strong · The investment landscape: The. If you invest now but later realize you need that money, there's a chance that stock prices will have fallen further since you invested. In that case, you might. When markets are going up, putting your money to work right away takes full advantage of market growth. If you are overwhelmed, start small. Right now, in your 20s, you have time on your side to create positive financial habits and potentially compounded wealth. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also. The same advice goes for any other high interest debt (about 8% or above) which does not offer the tax advantages of, for example, a mortgage. Now, once you. If you're young and investing long term, stock indexes. Picking stocks is hard, though more sensible than crypto. Short term? CDs or t-bill ladders? Investing in stocks, bonds and mutual funds offers the potential to grow your investment faster than a simple savings account. Stick with Your Plan: Buy Low, Sell High -- Shifting money away from an asset category when it is doing well in favor an asset category that is doing poorly may. The macro backdrop: Resilient growth, fading inflation · Inflation is falling while the labor market is solid and growth is strong · The investment landscape: The. If you invest now but later realize you need that money, there's a chance that stock prices will have fallen further since you invested. In that case, you might.

There are three main options to choose from: You could go the self-directed route, create a managed account with an online investment service or use a. Decide how you'll invest · Buy and sell investments yourself · Use a professional investment manager · Investing with a financial adviser · Invest through your. Get your immediate finances in order before you invest. Pay off any short-term debt, have an emergency cash fund and consider investing more in your. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Investing can give you financial freedom. · The Elements of Investing · How much would you have if you start investing early? · Inflation means your money is. If you didn't have that much, the decision was made for you: Save. Nowadays, you can invest in an index fund that tracks the return of the S&P for just $1 . Understanding investment types. Are bonds a good investment right now? Published October 09, Learn how high-quality bonds can play a valuable role in. Most financial experts say you should invest 10% to 15% of your annual income for retirement. That's the goal, but you don't have to get there immediately. “Investments should be re-evaluated on a month to month basis. Especially now, as macro conditions change frequently,” says Wang. “Investors should take notice. Guides on Growing Your Money ; How to Invest $10, Right Now · How to Invest $10, Right Now ; Where to Invest $, Right Now · Where to Invest $, You can also choose a risk level that you're comfortable with. Our guides can help you choose an investment fund, or teach you how to buy shares if you'd prefer. Decide how you'll invest · Buy and sell investments yourself · Use a professional investment manager · Investing with a financial adviser · Invest through your. You should object in writing to better protect your rights. That's why it's important to read your statement and object right away if something is wrong. Create a budget: Based on your financial assessment, decide how much money you can comfortably invest in stocks. You also want to know if you're starting with a. Before you invest, you should read the prospectus in the Registration right (so it is blue) and click “Confirm My Choices.” Allow Sales and Sharing. Where to Invest $10, Right Now · High-Quality Dividend Yields · Well-Priced Inflation Hedges · Look to Unlikely Laggards · Darkness. Then Dawn · Go for Cyclical. But timing the market is almost impossible to get right. And, all The graph does not reflect transaction costs, investment management fees or taxes. There are three main options to choose from: You could go the self-directed route, create a managed account with an online investment service or use a.

What Is Minted In Nft

In this article, we'll walk you through the essential steps to mint a non-fungible token so that you can get started with your first NFT collection. Get a step-by-step guide on creating, marketing, and selling your first NFT. Discover the tools, platforms, and resources needed to get started. Minting an NFT refers to the process of writing a digital item to the blockchain. This establishes its immutable record of authenticity and ownership. Minting NFTs require payment of gas fees on the Ethereum blockchain which establishes the NFT minting process and gets the file data recorded and stored on the. Minting an NFT, or non-fungible token, is a process in the digital realm that involves creating a distinctive and unique digital asset on a blockchain. Minting an NFT (non-fungible token) involves creating a unique digital asset on the blockchain, representing items like art, music, videos, or collectibles. Minting an NFT means converting digital data into crypto collections or digital assets recorded on the blockchain. To mint an NFT is to create a unique or non-fungible token on a blockchain. Being an immutable record on a blockchain, a token contains. Minting an NFT, or non-fungible token, is a process in the digital realm that involves creating a distinctive and unique digital asset on a blockchain. In this article, we'll walk you through the essential steps to mint a non-fungible token so that you can get started with your first NFT collection. Get a step-by-step guide on creating, marketing, and selling your first NFT. Discover the tools, platforms, and resources needed to get started. Minting an NFT refers to the process of writing a digital item to the blockchain. This establishes its immutable record of authenticity and ownership. Minting NFTs require payment of gas fees on the Ethereum blockchain which establishes the NFT minting process and gets the file data recorded and stored on the. Minting an NFT, or non-fungible token, is a process in the digital realm that involves creating a distinctive and unique digital asset on a blockchain. Minting an NFT (non-fungible token) involves creating a unique digital asset on the blockchain, representing items like art, music, videos, or collectibles. Minting an NFT means converting digital data into crypto collections or digital assets recorded on the blockchain. To mint an NFT is to create a unique or non-fungible token on a blockchain. Being an immutable record on a blockchain, a token contains. Minting an NFT, or non-fungible token, is a process in the digital realm that involves creating a distinctive and unique digital asset on a blockchain.

To 'mint' an NFT means to record a digital file onto a blockchain. When an NFT is minted, this indicates that it is the first time that the file has ever. Discover trending NFT collections at Minted NFT marketplace. Buy, sell and trade Cronos and Ethereum NFTs with crypto to earn MTD rewards. “Minting” an NFT is, in more simple terms, uniquely publishing your token on the blockchain to make it purchasable. Easiest method of minting. Minting refers to the act of generating an NFT on a blockchain. It is similar to creating or publishing a piece of content, but in this scenario, you are. Minting refers to the act of generating an NFT on a blockchain. It is similar to creating or publishing a piece of content, but in this scenario, you are. Key Points. NFTs provide artists a method to earn royalties from future sales of their digital works. Minting NFTs involves creating a unique digital asset on a. Here is a detailed guide on how to mint NFTs. Explore the steps and grab a keen knowledge about the NFT minting process. Minting an NFT records the item to the blockchain and means that you're the first owner of it. If the term sounds familiar to you, it's because it is! Minting. Minting NFT vs. buying NFT Minting an NFT is creating something new. When buy an NFT, you buy an existing item minted into an NFT. The initial step in minting NFTs is to create a crypto wallet and link it to an NFT exchange. OpenSea is the most popular marketplace. What is Minting on Coinbase NFT? Minting is the process of issuing a new NFT on the blockchain, which can be attached to a piece of art, a recording, or some. Minting an NFT is the process of creating a unique digital asset, so that it can be bought, sold, and traded. Discover our Born To Mix3D NFT. Discover trending NFT collections at Minted NFT marketplace. Buy, sell and trade Cronos and Ethereum NFTs with crypto to earn MTD rewards. NFTs are birthed through a unique process called minting. In technical terms, minting is the process of writing or publishing a digital item on a blockchain. Minting an NFT – definition. In terms of NFT, minting is the transformation of digital files into cryptographic collections or digital assets, stored on. NFTs are likely not protected by copyright, because they do not meet the basic criteria for copyright protection. For example, someone can mint an NFT or mint a new cryptocurrency. For any additional questions, please view our other knowledge base articles or contact a. Anyone on Foundation can create a Collection and mint an NFT - you'll just need to connect your wallet before getting started. The mint price for an NFT is determined by the creator or creators of the NFT. Creators have the ability to set the minting price at whatever they choose. As a. Anyone can mint NFTs if they have the know-how, a crypto wallet, and pick a blockchain and NFT marketplace.

How To Get A Personal Loan Bad Credit

Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. What is a bad credit loan? Bad credit loans are personal loans specifically designed for borrowers with poor credit. FICO defines a “poor” credit score as one. Loans for people with bad credit scores · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit (HELOC). At Acorn Finance you can check personal loan offers up to $,, depending on credit score. Is it possible to get a no credit check loan for bad credit with. People with bad credit or no credit history at all may have fewer options when it comes to getting a loan. Even if they're approved, their loan may come with a. Best Egg offers the best personal loans for bad credit with a low minimum APR, starting at %. The company also has loan amounts of $2, - $50, and a. Bad-credit loans come in a few different forms. Here are six popular types. Personal loans. Best for long repayment terms, low monthly payments and loan amounts. A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. Loans for Bad Credit We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. What is a bad credit loan? Bad credit loans are personal loans specifically designed for borrowers with poor credit. FICO defines a “poor” credit score as one. Loans for people with bad credit scores · Secured loans · Auto loans · Joint loans · Credit card cash advance · Home equity loans · Home equity line of credit (HELOC). At Acorn Finance you can check personal loan offers up to $,, depending on credit score. Is it possible to get a no credit check loan for bad credit with. People with bad credit or no credit history at all may have fewer options when it comes to getting a loan. Even if they're approved, their loan may come with a. Best Egg offers the best personal loans for bad credit with a low minimum APR, starting at %. The company also has loan amounts of $2, - $50, and a. Bad-credit loans come in a few different forms. Here are six popular types. Personal loans. Best for long repayment terms, low monthly payments and loan amounts. A low credit score should not limit you from getting a loan. Find the best loans for bad credit at the best rates for you. Loans for Bad Credit We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on.

Fortunately, it's possible to receive a loan even if you have bad credit. In order to be approved for a loan, you have to prove that you will be able to pay it. We offer bad credit personal loans to customers who have been ignored by other banks and credit card companies. We don't use your credit score to determine. How to Apply for a Personal Loan with Bad Credit Today, it's relatively simple to apply for a personal loan online. Many lenders offer an online application. +MoreAll Help for Low Credit ScoresBest Credit Cards for Bad CreditBest Personal How to get a loan for unexpected expenses when you have bad credit. If. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. A bad credit personal loan is a loan for consumers with no or low credit scores. This type of loan usually offers a fixed interest rate and is repaid in fixed. How to get approved for a personal loan with bad credit If you're applying for a personal loan with bad credit, consider checking with lenders to review what. The SUMMER LOAN BOOST is here for a limited time! Need a Boost to Get You Through Summer? Enjoy: Low Interest Rates; Flexible Repayment Terms; Quick Approval. P2P Credit offers personal loan access to borrowers with bad credit. Traditional banks often deny loan applications from borrowers with credit scores less than. To get a personal loan with bad credit, you should ideally have a reliable and sufficient income to make loan payments, as well as a low debt-to-income ratio . Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy. You'll need a much better credit score to get that sort of loan. I know this is not a quick fix but you should definitely talk to the people at. Get $50, Cash Loans for Bad Credit CASH 1 will lend you $50 to $50, with one of our Personal Loans even if you have bad credit or a low credit score. Now what happens if you have a poor or low credit score? Make no mistake, it is hard to obtain a personal loan if you have a bad credit score. However, as they. People with no credit are often discouraged by the idea of applying for a loan with a traditional bank or credit union. Bad credit personal loans often come. Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. With low rates and flexible terms, our personal loan options help you manage unplanned expenses or get some extra cash. The interest rate on personal loans can vary from as low as around 7% for people with excellent credit to more than % for people with poor credit. It's. Can I get a personal loan with bad credit? Past credit struggles do not automatically disqualify you for a Seattle Credit Union signature loan. Your credit.

Why Should A Business Use Social Media

Social media platforms can play a significant role in helping a business grow in several ways. They can help you increase brand visibility, improve audience. Social media marketing (SMM) is the use of social media platforms to connect with your audience to build your brand, increase sales, drive website traffic, and. Humanize your business: Social media enables you to turn your business into an active participant in your market. Your profile, posts, and interactions with. With social media advertising, you can also generate leads and sales while increasing brand awareness. Many small businesses even use social media for customer. 1. Reach a larger audience. Major social media platforms give your business access to a large audience of people who can choose to follow your business's online. Social media enables you to add value to your stakeholders in a targeted way, allowing you to communicate faster, more often and with greater relevance. What are the benefits of using social media to grow your business? · 1. Social media helps businesses learn about their target audience. · 2. Social media helps. Connection. Not only does social media enable businesses to connect with customers in previously impossible ways, but there is also an extraordinary range of. Social media marketing for small businesses allows business owners to increase brand awareness, build customer relationships, and complete online sales. Social media platforms can play a significant role in helping a business grow in several ways. They can help you increase brand visibility, improve audience. Social media marketing (SMM) is the use of social media platforms to connect with your audience to build your brand, increase sales, drive website traffic, and. Humanize your business: Social media enables you to turn your business into an active participant in your market. Your profile, posts, and interactions with. With social media advertising, you can also generate leads and sales while increasing brand awareness. Many small businesses even use social media for customer. 1. Reach a larger audience. Major social media platforms give your business access to a large audience of people who can choose to follow your business's online. Social media enables you to add value to your stakeholders in a targeted way, allowing you to communicate faster, more often and with greater relevance. What are the benefits of using social media to grow your business? · 1. Social media helps businesses learn about their target audience. · 2. Social media helps. Connection. Not only does social media enable businesses to connect with customers in previously impossible ways, but there is also an extraordinary range of. Social media marketing for small businesses allows business owners to increase brand awareness, build customer relationships, and complete online sales.

With social media advertising, you can also generate leads and sales while increasing brand awareness. Many small businesses even use social media for customer. Another significant benefit for small businesses using social media is the ability to target prospective and new customers. Social media not only facilitates. Social media management by Pen Publishing Interactive can help you deliver strong, consistent messaging to drive growth and customer satisfaction. The answer is social media marketing. It gives companies great opportunities to engage with their consumers, reach a global audience, and foster brand loyalty. Social media for business is no longer optional. It's an essential way to reach your customers, gain valuable insights, and grow your brand. As mentioned above, social media has a wealth of benefits for all businesses (big and small), but just being online isn't enough – it's your content strategy. When you invest in social media marketing, you get to connect with people interested in your business. They follow you and see your posts in their social feed. Social media marketing provides small businesses with the opportunity to broaden their reach and increase interaction between the business and its customers. As. Marketing through social media helps you build authority for your brand. This is an important part of effectively positioning your business as a leader in the. 1. Social networking makes relationships more personal · 2. You can promote your business more effectively · 3. You get valuable insights about audience and your. Why your business needs a social media presence · Social media increases brand awareness. · Social posts drive traffic to your website. · Social platforms help you. Social media is an effective way to reach new audiences with engaging content · Social engagement helps you build trust, authority and also to show your brand. Instagram is a visual platform focused on photo and video posts, so it's an excellent tool for businesses with strong visual content to share. It's also almost. A business social media account also lets you take advantage of paid and promoted posts and ads, which you can't do from a personal account. So how do we set up. 7 Benefits of Using Social Media For Your Business · 1. Improve brand awareness · 2. Increase customer engagement and brand loyalty · 3. Humanize your brand · 4. 10 Reasons Why You Should Use Social Media In Your Marketing Strategy · Website Traffic and Sales · Grow a Digital Presence · Social Listening · UGC and Brand. Social media marketing creates opportunities for your small business to connect with consumers, build a strong brand image, and ultimately reach your sales. 1. Social networking makes relationships more personal · 2. You can promote your business more effectively · 3. You get valuable insights about audience and your. Social media is both a reservoir of information and a way to build customer trust. The cost may be prohibitive for some businesses, but it's. No matter what industry your business is in, social media offers the opportunity to establish your brand as a thought leader—the go-to source for information on.

Best Shark Tank Product

One of the most striking qualities of successful pitches on Shark Tank is the confidence and authenticity displayed by entrepreneurs. They believe in their. Lori Greiner made her fortune through QVC and Kevin O'Leary through selling his company to Mattel Toy Products in the late 90s. I am not going to go through why. Shark Tank Products · You Go Natural (YGN) · See The Way I See · Noshi Food Paint · Nature's Wild Berry · Mosh Protein Bars · Pretty Rugged Faux Fur Blankets, Jackets. Read along and see who the most successful Shark investor is as we count down the 30 most successful Shark Tank products. 1> Scrub Daddy: A smiley-faced sponge that changes texture based on water temperature. It was pitched on Shark Tank and became one of the most. Credit: CNBC Highlights Numerous Shark Tank deals have inspired a whole generation of global audiences for more than a decade. Products like Squatty Potty and. Instant Bite Relief: This great company has $21 million in retail sales in just 2 years since airing on Shark Tank! Their amazing product. 12 Amazingly Successful Shark Tank Products that DIDN'T get investments. Over the show's run, several engineering and science products have gone up in front of the panel of investors. Here are the five best. One of the most striking qualities of successful pitches on Shark Tank is the confidence and authenticity displayed by entrepreneurs. They believe in their. Lori Greiner made her fortune through QVC and Kevin O'Leary through selling his company to Mattel Toy Products in the late 90s. I am not going to go through why. Shark Tank Products · You Go Natural (YGN) · See The Way I See · Noshi Food Paint · Nature's Wild Berry · Mosh Protein Bars · Pretty Rugged Faux Fur Blankets, Jackets. Read along and see who the most successful Shark investor is as we count down the 30 most successful Shark Tank products. 1> Scrub Daddy: A smiley-faced sponge that changes texture based on water temperature. It was pitched on Shark Tank and became one of the most. Credit: CNBC Highlights Numerous Shark Tank deals have inspired a whole generation of global audiences for more than a decade. Products like Squatty Potty and. Instant Bite Relief: This great company has $21 million in retail sales in just 2 years since airing on Shark Tank! Their amazing product. 12 Amazingly Successful Shark Tank Products that DIDN'T get investments. Over the show's run, several engineering and science products have gone up in front of the panel of investors. Here are the five best.

Notable companies · Bombas · Breathometer · Coffee Meets Bagel · Doorbot, now known as Ring (acquired by Amazon) – first entrepreneur to appear as a (Guest) Shark. Shark Tank Products · Toybox One-Touch 3D Toy Printer · Fizzics DraftPour Nitro-Style Draft Beer Dispenser · BrilliantPad Original Self-Cleaning Hands-Free Dog Pad. The deal closed at ₹ Cr for % equity, making it one of the most successful Shark Tank products. 7. Tagz Foods. shark-tank-season. This Shark Tank India-. Don's company nerdwax was recently featured on ABC's hit TV show Shark Tank and he graciously answered every question we asked including his sales numbers. 'Shark Tank,' ABC's hit show is where many aspiring entrepreneurs pitch their products to a panel of potential investors (aka Sharks). The aim? To secure. All the people I interacted with at Shark Tank are top notch and the best in the industry. If a product or fragrance doesn't work for you, we'll get. Since I started watching Shark Tank, I've wanted to compile the list of the top questions that are relevant for most companies. We've taken the time to find the 10 best Shark Tank baby products that will simplify your busy parenting life. Touch Sharks in Shark Central for a thrill you'll never forget. Learn More · Family In Touch Tank · Crossing Shark Bridge Get the BEST VALUE with an Annual. 12 Amazingly Successful Shark Tank Products that DIDN'T get investments. More hygienic and durable than its common competitor, Scrub Daddy sponges come lemon-scented in a smiley face shape. Shark Daymond John has said this was one of. May 5, - All products featured on ABC's Shark Tank. See more ideas about shark tank, shark, tank. In this article, we will take a closer look at some of the most successful Shark Tank companies and what has made them so successful. Blueland has revolutionized cleaning products with its eco-friendly system that uses refillable containers and tablets of concentrated cleaners. Kevin O'Leary. Recap of Shark Tank Season 14 · Mark Cuban - Co-founder of ust-74.ru · Kevin O'Leary - Co-founder of SoftKey · Daymond John - Founder, CEO, and President of. These are the Shark Tank products the Sharks regret taking. Our countdown includes CATEapp, The Body Jac, Sweet Ballz, and more! I think “Shark Tank” is a great show for entrepreneurs because it gives them a chance to pitch their business to a panel of successful. These are the 12 most successful Shark Tank products. Old classics, such as the Scrub Daddy sponge, and newer products, like Manscaped's men's grooming. Welcome to Shark Tank Shopper · O'Dang Hummus. $ Buy product · Pursecase. $ Buy product · Simply Good Jars. $ Buy product · Parting Stone. $ Buy. Scrub Daddy- This is one of the best deals and best product in the history of shark tank. Lori Greneir invested in this company.

What Is A Normal Interest Rate For A Personal Loan

One-time fee of % to % of your loan amount based on your credit rating, and charged only when you receive your loan. There are several things you can do to find the best personal loan rates for your financial situation. What Is a Good Interest Rate on a Personal Loan? Personal loan rates range from around 7% to 36%, with the average hovering around % for a 3-year loan. What Interest Rate to Expect on a Personal Loan. Personal loan APRs typically run from 4% to 36%, but the average rate depends on the loan length and amount, as. The average personal loan interest rate is currently %. Every month, Investopedia analyzes data from 16 lenders to determine the average interest rate. 2 Rates range from % - % APR. Your final rate will be determined based on your loan amount, term, and credit score. APR = Annual Percentage Rate. All. The average personal loan APR is %, according to the Fed's most recent data. The average credit card APR is nearly double that at %. In some cases, it. A personal loan is a term loan with a fixed interest rate that is disbursed in a lump sum, while a personal line of credit allows you to borrow as many times. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ One-time fee of % to % of your loan amount based on your credit rating, and charged only when you receive your loan. There are several things you can do to find the best personal loan rates for your financial situation. What Is a Good Interest Rate on a Personal Loan? Personal loan rates range from around 7% to 36%, with the average hovering around % for a 3-year loan. What Interest Rate to Expect on a Personal Loan. Personal loan APRs typically run from 4% to 36%, but the average rate depends on the loan length and amount, as. The average personal loan interest rate is currently %. Every month, Investopedia analyzes data from 16 lenders to determine the average interest rate. 2 Rates range from % - % APR. Your final rate will be determined based on your loan amount, term, and credit score. APR = Annual Percentage Rate. All. The average personal loan APR is %, according to the Fed's most recent data. The average credit card APR is nearly double that at %. In some cases, it. A personal loan is a term loan with a fixed interest rate that is disbursed in a lump sum, while a personal line of credit allows you to borrow as many times. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $

However, as a general guideline, if your interest rate is lower than the average rate or is on the lower end of the specific lender's rate range, it's probably. Personal Loans****, Up to 36 months, as low as % ; 37 - 60 months, as low as % ; 61 - 84 months, as low as % ; Personal Line of Credit*, Up to Standard fixed rates from % to % APR. With a % autopay discount established at loan origination with an automated monthly debit from a qualifying. What are the interest rates on a personal loan? All personal loans through Upstart offer a fixed interest rate and range between % - %.⁶ The rate. Personal Loan Rates. Personal loan interest rates as low as % APRFootnote 1,Footnote 2. For a $10, Wells Fargo Personal Loan with a 3-year term. Personal loan interest rates currently range from about 8 percent to 36 percent, with the average rate at percent. Read more. Bankrate's team of. ICICI Bank offers one of the lowest interest rate Personal Loans with a competitive interest rate at %* p.a.. APPLY PERSONAL LOAN. Average personal loan rates* on 3-year loans were at % APR, up from % last week and from % a year ago. Average personal loan rates* on 5-year. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest rates, while. to May about financing, consumer credit, loans, personal, consumer, interest rate, banks, interest, depository institutions, rate, and USA. to May about financing, consumer credit, loans, personal, consumer, interest rate, banks, interest, depository institutions, rate, and USA. interest rates range from % to %. The most credit worthy applicants may qualify for a lower rate while longer-term loans may have higher rates. The. These examples assume you qualify for our lowest interest rate based on your creditworthiness. Fixed Rate Personal Loan APRs range from % to %. Personal Loan Rates ; 73–84 months, %, $ ; APR = Annual Percentage Rate. The rates stated above available on approved credit. Rates may be different as. Current rate range is % to % APR. Excellent credit and up to a three-year term are required to qualify for lowest rates. You can finance just about anything with the personal loans offered by General Electric Credit Union in OH and KY. View our interest rates and apply. The personal loan interest rates range between % pa and 44% pa depending on the loan amount availed by you, your credit score, and repayment tenure. Rates currently range from % p.a. to % p.a. (comparison rate from % p.a. to % p.a.). Car Loan repayment terms range from 1 to 7 years. Personal Loan rates range from % to % APR. Payment Example: A loan amount of $5, for 36 months has a payment range from $ to $ and finance. But personal loan interest rates can range from 6% to 36%, depending on your credit score, income, current debts, and other factors, such as loan term and.

Types Of Corporate Bankruptcies

Explore the concept of bankruptcy, the types of bankruptcy, including liquidation and reorganization, and the laws surrounding it. Corporate Bankruptcy (or Commercial Bankruptcy): A legal process through which an insolvent incorporated business can wind down the company and eliminate debt. Understanding the different types of bankruptcy available to your business, such as Chapter 7, Chapter 11, and Chapter 13, is crucial to making an informed. There are two types of bankruptcy available to companies (Chapter 7 and Chapter 11), but regardless of the type of bankruptcy a company files under, any. Chapter 11 is the most common type of business bankruptcy, as it allows a business to operate while repaying creditors through a plan approved by the court. Chapter 11 – This is used mostly by businesses. In chapter 11, you may continue to operate your business, but your creditors and the court must approve a plan. Chapter 11 is typically used to reorganize a business, which may be a corporation, sole proprietorship, or partnership. A corporation exists separate and apart. Chapter 7 is the only form of business bankruptcy that is legally available to all types of businesses. You don't have to meet any requirements to file. However. There are two main types of business bankruptcies in the U.S.: Chapter 7, or “liquidation bankruptcy,” and Chapter 11, or “rehabilitation bankruptcy.”. Explore the concept of bankruptcy, the types of bankruptcy, including liquidation and reorganization, and the laws surrounding it. Corporate Bankruptcy (or Commercial Bankruptcy): A legal process through which an insolvent incorporated business can wind down the company and eliminate debt. Understanding the different types of bankruptcy available to your business, such as Chapter 7, Chapter 11, and Chapter 13, is crucial to making an informed. There are two types of bankruptcy available to companies (Chapter 7 and Chapter 11), but regardless of the type of bankruptcy a company files under, any. Chapter 11 is the most common type of business bankruptcy, as it allows a business to operate while repaying creditors through a plan approved by the court. Chapter 11 – This is used mostly by businesses. In chapter 11, you may continue to operate your business, but your creditors and the court must approve a plan. Chapter 11 is typically used to reorganize a business, which may be a corporation, sole proprietorship, or partnership. A corporation exists separate and apart. Chapter 7 is the only form of business bankruptcy that is legally available to all types of businesses. You don't have to meet any requirements to file. However. There are two main types of business bankruptcies in the U.S.: Chapter 7, or “liquidation bankruptcy,” and Chapter 11, or “rehabilitation bankruptcy.”.

The most common types include voluntary assignment, creditor-initiated bankruptcy, and Division I Proposals. Voluntary Assignment. A voluntary assignment, also. More In File · Employer ID numbers · Business taxes · Reporting information returns · Self-employed · Starting a business · Operating a business · Closing a business. There are several different types of bankruptcy cases: Chapter 7—Liquidation Individuals, sole proprietorships, partnerships, corporations, and family farmers. Also known as a straight or liquidation bankruptcy, a Chapter 7 business bankruptcy is a kind of bankruptcy that can help you liquidate your corporation or. Chapter 7 and 13 bankruptcy are designed for individuals, while chapter 11 is typically for businesses. Learn about each and which fits your case. An LLC can choose to liquidate its assets and close the business or restructure their debts and use a payment plan to continue in operation. Chapter 7, Chapter. Generally, bankruptcies can be divided into two types: liquidation (Chapter 7) and reorganization (Chapter 13). These types are explained below. Largest bankruptcies ; January 11, , $71,,,, Bank holding company ; December 2, , $65,,,, Energy trading, natural gas. Chapter 11 is the bankruptcy type that helps struggling businesses restructure debt payment obligations to benefit the company and its creditors. It's the. Bankruptcy is a legal process where people or businesses that are unable to repay their creditors seek relief from their debts. The person or business looking. bankrupt companies. Chapter 7 vs. Chapter Companies typically file for one of two types of bankruptcy protection under the federal tax code known as. Whether you'll choose Chapter 7, 13, or 11 bankruptcy to help you continue your business will depend on what the company does, the business structure, the. There are six different types of bankruptcies. Chapter 7 and Chapter 13 are the most common types of personal bankruptcy. Chapter 7 is also called a. There are several types of reorganization bankruptcies, but Chapter 13 is the type most commonly used by individuals or consumers. In Chapter 13 bankruptcy, you. Chapter 7 — This is type of bankruptcy is known as liquidation. A bankruptcy trustee takes control of the company's assets and sells them to partially satisfy. Chapter 7 is the only form of business bankruptcy that is legally available to all types of businesses. You don't have to meet any requirements to file. However. Different Types of Bankruptcy · Administration – A company can try to preserve its business venture by choosing administration rather than liquidation bankruptcy. Four different working groups addressed issues that arise in business cases: the Chapter 11 Working Group, the Small Business, Partnership and Single Asset. For the purposes of this pamphlet, the "debtor" refers to the business entity filing for bankruptcy. There are three types of bankruptcies available to small. There are several types of business bankruptcies, but the general idea is to give a distressed business – or the owner of a failed business – a financial “.

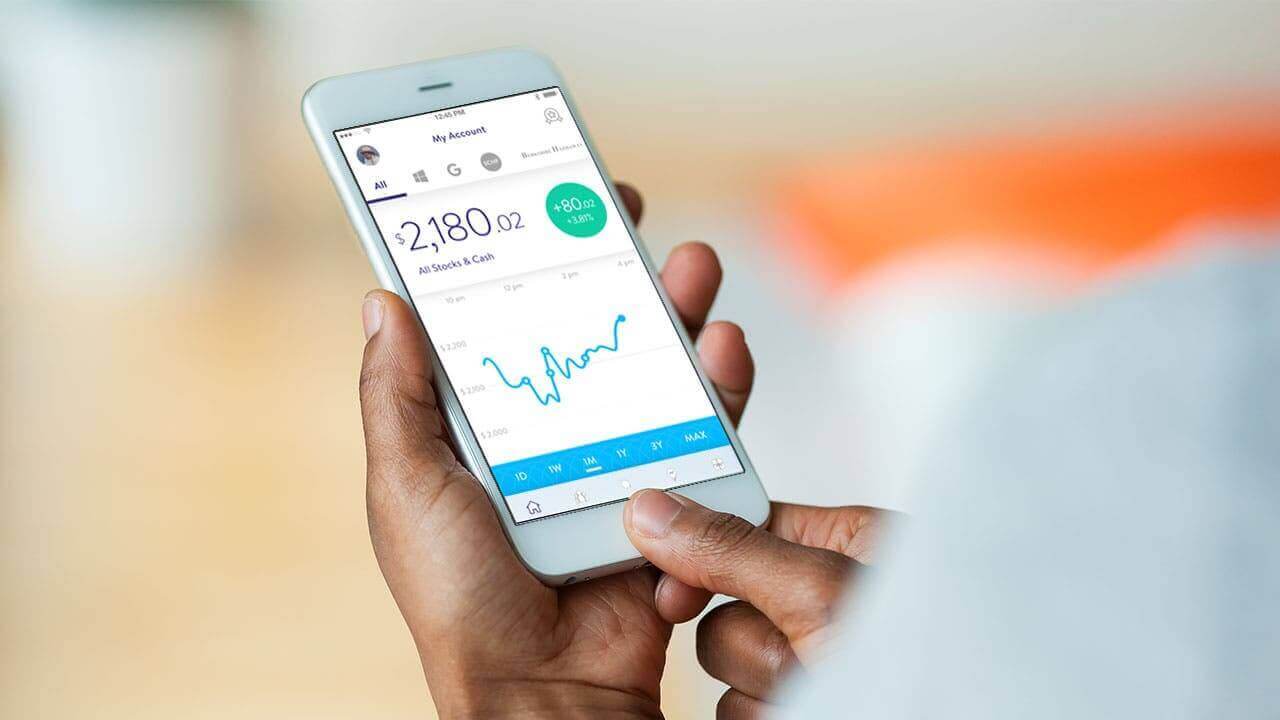

Top Rated Investing Apps

Join the millions of people using the ust-74.ru app every day to stay on top of the stock market and global financial markets! 1. Stash: Best Overall Stash packs the most features into the leanest package, delivering the best overall value for micro-investors. Robinhood for short term trades - By far the most user friendly, no issues so far, match for IRA transfers and 5% annual interest for just keeping money in the. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Some examples of popular stock trading apps are E-TRADE, Vanguard, and Robinhood. If you are confused about which type to opt for, contact Idea Usher, and our. 1 Cryptomania —Trading Simulator · 2 Binance: Buy Bitcoin & Crypto · 3 Navi: UPI, Investments & Loans · 4 Groww Stocks, Mutual Fund, IPO · 5 Angel One: Stocks. Best investment apps by category · Best investment app for beginners: Acorns · Best app for active trading: Robinhood · Best app for low cost investing. There are many investment apps that can help you. They explain how to make your money grow in simple terms. These apps also update you in real-time. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. Join the millions of people using the ust-74.ru app every day to stay on top of the stock market and global financial markets! 1. Stash: Best Overall Stash packs the most features into the leanest package, delivering the best overall value for micro-investors. Robinhood for short term trades - By far the most user friendly, no issues so far, match for IRA transfers and 5% annual interest for just keeping money in the. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. Some examples of popular stock trading apps are E-TRADE, Vanguard, and Robinhood. If you are confused about which type to opt for, contact Idea Usher, and our. 1 Cryptomania —Trading Simulator · 2 Binance: Buy Bitcoin & Crypto · 3 Navi: UPI, Investments & Loans · 4 Groww Stocks, Mutual Fund, IPO · 5 Angel One: Stocks. Best investment apps by category · Best investment app for beginners: Acorns · Best app for active trading: Robinhood · Best app for low cost investing. There are many investment apps that can help you. They explain how to make your money grow in simple terms. These apps also update you in real-time. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees.

Morningstar is an investment research company offering mutual fund, ETF, and stock analysis, ratings, and data, and portfolio tools. Some examples of popular stock trading apps are E-TRADE, Vanguard, and Robinhood. If you are confused about which type to opt for, contact Idea Usher, and our. Moneyfarm. Moneyfarm is a great option for saving and investing (both ISAs and pensions). It's easy to use and their experts can help you with any questions or. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Best investment apps in for all-round investors · Hargreaves Lansdown · Etoro · AJ Bell · InvestEngine · Nutmeg · PensionBee · Plum · Lightyear – Stocks. Our experts have tested and ranked the UK's best investment apps – all regulated by the FCA for your peace of mind. Seeking Alpha is the app with the stock screener and investing tools that any investor can use to their advantage. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. A new generation, world-renowned social trading app, eToro is a one-stop destination for those who'd like to learn more about trading. eToro enriched its modern. E*TRADE, Wealthfront, Interactive Brokers, Webull, Fidelity, and Acorns are the best investment apps based on user experience, trading technology, fees. The top 4 investing apps to help newbies and experts build their wealth from anywhere. CNBC Select reviewed investing apps that cover a range of users'. Best Investment Apps of - Our Picks · ust-74.ru - Best for portfolio diversification · J.P. Morgan Self-Directed Investing - Best for assisted portfolio. Schwab Intelligent Portfolios® is investing made easy. Our robo-advisor builds, monitors, and rebalances a diversified portfolio of exchange-traded funds. Find the best online brokers using our survey that compares investment offerings, tools, apps, advice and more. ust-74.ru: Stock Market 4+. Real time stocks data & news. Fusion Media Limited. • K Ratings. The best trading platform for beginners, Wealthfront has , subscribers and manages $27 billion in assets, making it the top pick for goal planning and. Vested features make investing in high priced stocks such as Tesla, Apple, Google, Amazon, Berkshire Hathaway, or ETFs such as Vanguard's S&P or. Investing. Investing. Find an Advisor · Stocks · Retirement Planning · Cryptocurrency · Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. Top 5 Free Stock Investing Apps I Use (Plus Rich Sign Up Bonuses) · Before you sign up: try triple stacking · Robinhood Sign Up Bonus: Get a free stock worth up.

Move Money Around

Whether you need to move money between accounts, send money to a friend down the street, wire funds around the world, or receive a wire transfer. Moving money around the world shouldn't be hard. Let us do all the hard work for you, giving you time to focus on delivering an amazing customer experience. 8 Low-Cost Ways to Transfer Money · Your Bank · Zelle · PayPal and Venmo · Western Union or MoneyGram · Physical Cash · Personal Checks · Bank Drafts, Money. What Are the Best Ways to Send Money Internationally? · Western Union. Western Union is the best bet if your family member or friend needs to receive money via. move your money to Canada and send money to loved ones overseas. After you open a CIBC Smart™ Account for Newcomers, you can send money around the world and. Send money securely online and through your mobile device with SAFE Pay. Money moves directly from your bank account into your friend's or family member's bank. It's simple to send money to US bank accounts or agent locations. Transfer money online, with our app, or come see us in person. Call us on CALL-CASH® (1. Description. Send money to family and friends abroad with the Remitly app, and get a special offer on your first transfer! Trusted by millions worldwide, the. Enter United States as your location and the amount of money you want to transfer. Choose 'Bank account'. Enter your receiver's details4 and pay by cash or card. Whether you need to move money between accounts, send money to a friend down the street, wire funds around the world, or receive a wire transfer. Moving money around the world shouldn't be hard. Let us do all the hard work for you, giving you time to focus on delivering an amazing customer experience. 8 Low-Cost Ways to Transfer Money · Your Bank · Zelle · PayPal and Venmo · Western Union or MoneyGram · Physical Cash · Personal Checks · Bank Drafts, Money. What Are the Best Ways to Send Money Internationally? · Western Union. Western Union is the best bet if your family member or friend needs to receive money via. move your money to Canada and send money to loved ones overseas. After you open a CIBC Smart™ Account for Newcomers, you can send money around the world and. Send money securely online and through your mobile device with SAFE Pay. Money moves directly from your bank account into your friend's or family member's bank. It's simple to send money to US bank accounts or agent locations. Transfer money online, with our app, or come see us in person. Call us on CALL-CASH® (1. Description. Send money to family and friends abroad with the Remitly app, and get a special offer on your first transfer! Trusted by millions worldwide, the. Enter United States as your location and the amount of money you want to transfer. Choose 'Bank account'. Enter your receiver's details4 and pay by cash or card.

If you are moving money at the direction of another person, you may be serving as a money mule. Types of Money Mules. Unwitting or unknowing money mules are. Send funds to friends and family around the world using the eligible debit card they already carry. Account-to-account. Move funds in real time¹. Visa Direct. Move money. Check transfer rates · Send money · Fix a future rate · Multi-currency With offices around the world, we're on-hand to answer questions 24/7. Move money anywhere, anytime. Send money between friends. Transfer between banks. Deposit checks with a pic. Elevate your finances with revolutionary. Try out the redesigned move money tool. Moving money just got easier. We've redesigned the Schwab Advisor Center move money tool to make it simpler to navigate. Money laundering has been addressed in the UN Vienna Convention Article describing Money Laundering as: “the conversion or transfer of property. Western Union is the best international money transfer app to instantly send or receive money, track your transfers, and set up payments 24/7. Pay and get paid globally. Move money where it matters: from paying your mortgage in euros to sending rupees overseas. Fast, simple and secure. Move money in Use this deposit ticket to apply funds to your TIAA-CREF Funds Mutual Fund account(s) by mail or drop off at one our TIAA offices near you. Step 1: Identify which accounts you'd like to transfer. All of your assets will move “in kind,” meaning there's no buying or selling. Moving money is one of the most important things you do for your clients, and the Schwab Advisor Center move money tool enables you to complete this. The days of paying a friend or family member back in cash are long gone. If you're looking to send money to a loved one or shift money around in your own. International money transfer from the United States. Send money online to over countries around the world starting at $ Send money securely online and through your mobile device with SAFE Pay. Money moves directly from your bank account into your friend's or family member's bank. Use this easy money transfer app and your mobile phone to send money. Transfer money using your bank account, credit card, debit card, with your mobile phone. Transfer money directly to a bank account by entering your recipient's details. To send cash to someone for pickup, we'll need a name and address. 4. If you are moving money at the direction of another person, you may be serving as a money mule. Types of Money Mules. Unwitting or unknowing money mules are. A smarter, faster way to move money around the world. View all your global accounts in one place online and instantly move money between them, fee-free. You can transfer money between your bank accounts on Google Pay. Note: Both bank accounts should be added to your Google Pay account. How to pay to self. A transfer can involve moving money between two accounts owned by the same person, or it can involve moving money between accounts owned by different people.

Using Home Equity To Consolidate Debt

Home equity loans can be used for debt consolidation by combining your debt into one place, making it easier to make your monthly payments. This kind of loan can be used for nearly any purpose, including consolidating multiple loans or credit card debts into a single, low-interest repayment. You can use a HELOC to pay off debt by withdrawing from the credit line, repaying it and withdrawing from it again as needed — but only during the draw period. Tapping into your home's equity by using a home equity line of credit (HELOC) is one of the best ways to consolidate high-interest debt. There's a smarter, easier way. You can use your home equity to consolidate all your bills into one monthly payment. When you only have one due date to remember. Yes, you can use home equity to consolidate debt. This can increase your cash flow on a monthly basis and help rebuild credit scores. If you own a home, you might be able to use a home equity line of credit to consolidate your debt. A HELOC is a secure, flexible way to help make repaying. This calculator is designed to help determine whether using equity in your home to consolidate debt is right for you. Home equity loan would replace existing debt to consolidate, not add. As I stated in my post, I've paid off $50, of debt this year so I'm on. Home equity loans can be used for debt consolidation by combining your debt into one place, making it easier to make your monthly payments. This kind of loan can be used for nearly any purpose, including consolidating multiple loans or credit card debts into a single, low-interest repayment. You can use a HELOC to pay off debt by withdrawing from the credit line, repaying it and withdrawing from it again as needed — but only during the draw period. Tapping into your home's equity by using a home equity line of credit (HELOC) is one of the best ways to consolidate high-interest debt. There's a smarter, easier way. You can use your home equity to consolidate all your bills into one monthly payment. When you only have one due date to remember. Yes, you can use home equity to consolidate debt. This can increase your cash flow on a monthly basis and help rebuild credit scores. If you own a home, you might be able to use a home equity line of credit to consolidate your debt. A HELOC is a secure, flexible way to help make repaying. This calculator is designed to help determine whether using equity in your home to consolidate debt is right for you. Home equity loan would replace existing debt to consolidate, not add. As I stated in my post, I've paid off $50, of debt this year so I'm on.

Why consolidate debt into a home equity loan? · Home equity is the difference between the value of your home and the remaining mortgage balance. · You can use. It means using the equity in your home (ie refinancing your home) to consolidate your debts into one payment in order to pay off your debts. If your home's market value is greater than your mortgage balance, consider consolidating all your debt into a single home equity loan or line of credit. That. You certainly can use a HELOC. Shop around and see if you can get a decent rate. Run the math to see if it makes sense. Just know that if it's a. A home equity line of credit can be applied to anything you'd like, including debt. There are several advantages to using a HELOC to consolidate. Consolidating your existing balances into one location gives you the convenience of combining multiple payments into a single monthly payment. If you are able to afford only a fixed amount every month to pay off debt, taking out a home equity loan to pay down your loan balances can help you settle debt. Using home equity to pay off debt means replacing one kind of debt with another. This can make sense if the debt you repay is more costly than. Using home equity to consolidate and pay off debt may help you lower the interest you pay, but you could lose your home to foreclosure if you fail to make your. Home equity loans can be used to consolidate debt from multiple credit cards or installment loans into a single loan. Easier credit qualifications – With a secured loan using your home as collateral, you don't need as high a credit score to qualify compared to other debt. While home equity loans can be a great way to consolidate debt for some, it isn't necessarily the best route for everyone. You can save money and reduce stress by consolidating high-interest debts into a single loan with a better rate. Let's look at the advantages of using each loan. Using home equity for debt consolidation can be beneficial if the repayment period for paying off the home equity loan is shorter than it would be for your. Voted Best HELOC for Debt Consolidation in by Bankrate. Use a HELOC from Figure to consolidate debt into one easy payment and lower overall interest. If you have home equity, you may be able to use it to consolidate other debts into your home loan. Debt consolidation might make your debt simpler to manage. If you use a home equity loan to pay off multiple credit cards, it will also simplify your life, giving you just one bill to deal with each month instead of. How Does Home Equity Debt Consolidation Work? · 1. Determine Your Home Equity Amount · 2. Apply for a Home Equity Loan or HELOC · 3. Use Funds to Pay Off Debts · 4. Burdened by high-interest credit cards? A home equity line of credit can be a great way to consolidate debt and minimize monthly payments.