Mercer Boffey’s Legal Challenge to Council Tax Dismissed by High Court

Initially, a duo of Hollywood actors made headlines in Welsh football, and now another American TV star has sought to challenge the local government taxation framework in the UK.

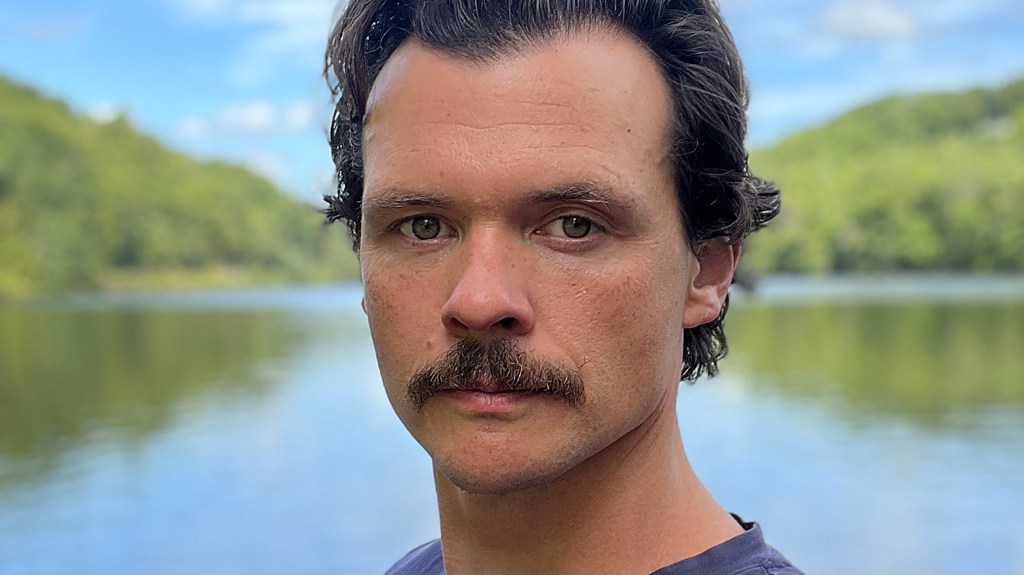

Mercer Boffey, recognized for his roles in shows like Ugly Betty, It’s Always Sunny in Philadelphia, and NCIS: Los Angeles, initiated a legal action against council tax, which a judge noted could “undermine” the collection of vast public revenues.

Following his acquisition of a grade II listed residence in London, Boffey, aged 42, argued in court for “the absolute right in every Englishman” — inclusive of a lawfully residing American in his own “castle” — to the “free use, enjoyment, and disposal of all his acquisitions, without any control or diminution, save only by the laws of the land.”

Consequently, over the course of a two-year legal battle, Boffey claimed that the council tax should be abolished for homeowners using their properties exclusively for personal use.

However, despite the judge acknowledging Boffey’s “articulate” arguments, the claims were rejected because ruling in his favor would have jeopardized “the lawfulness of many billions of pounds raised by local authorities under successive governments over the past thirty years.”

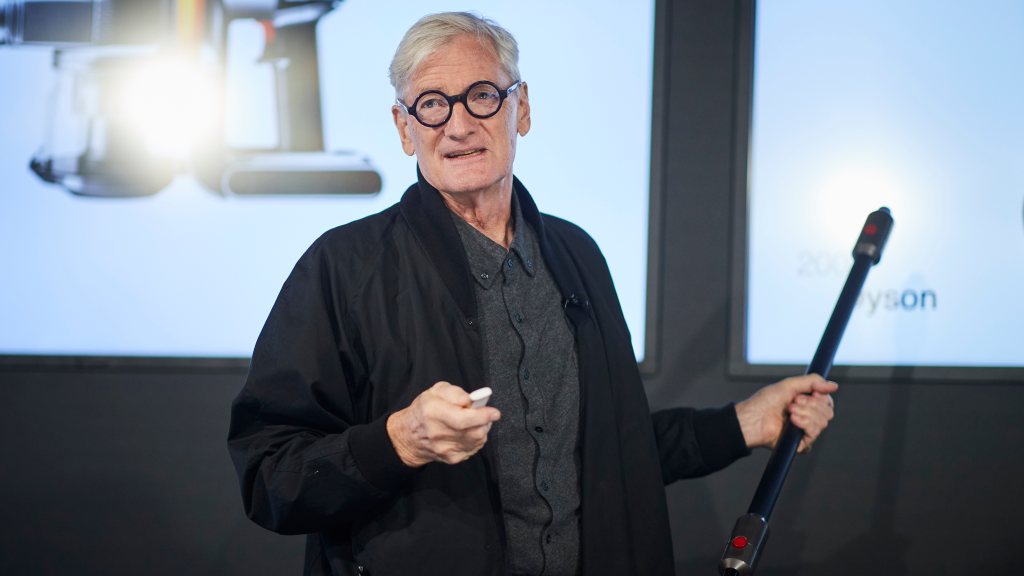

Boffey’s appeal took place four years after fellow actors Ryan Reynolds and Rob McElhenney garnered worldwide attention by purchasing Wrexham FC for around £2 million, a transaction highlighted in the documentary series, Welcome to Wrexham.

While Wrexham FC continues to thrive under the ownership of those stars, Boffey’s legal endeavor proved unsuccessful.

The High Court was informed that in 2018, Boffey and his wife relocated to a picturesque Queen Anne house located in the “enchanting hamlet” of Petersham in southwest London.

This property fell under the jurisdiction of the London Borough of Richmond for council tax, categorized in band H, which incurs an annual charge of £4,282.

In 2023, Boffey contested his tax liability and requested the removal of his property from the council tax roll.

After local authorities declined his request, Boffey pursued the matter with the Valuation Tribunal for England.

Although he lost, he later claimed that the tribunal potentially violated his due process rights in defending against an unwarranted claim from a public entity.

Additionally, Boffey asserted that the tribunal’s decision was based on an “inconsistent interpretation of well-settled law,” leading him to appeal to the High Court.

During the proceedings, Mr. Justice Constable explained that Boffey believed his residence did not meet the criteria for tax liability because it was solely for his family’s use and that he had not sought any rental permissions as a licensed property provider.

The judge remarked that if Boffey’s arguments were valid, it would seriously impact the legality of billions raised by local governments, given that his family’s situation was no different from that of millions of homeowners nationwide.

However, Constable reassured local government officials by stating it was “simply incorrect to assert that a conventional dwelling — a privately owned house or flat, used only for living accommodation with no financial gain — fell outside the scope” of the tax.

Post-hearing, Boffey expressed his desire to explore statutory legislation and property rights, noting that many individuals felt disenfranchised.

He concluded by stating his profound curiosity regarding the application of property, tax, and citizens’ rights under the law.

Post Comment