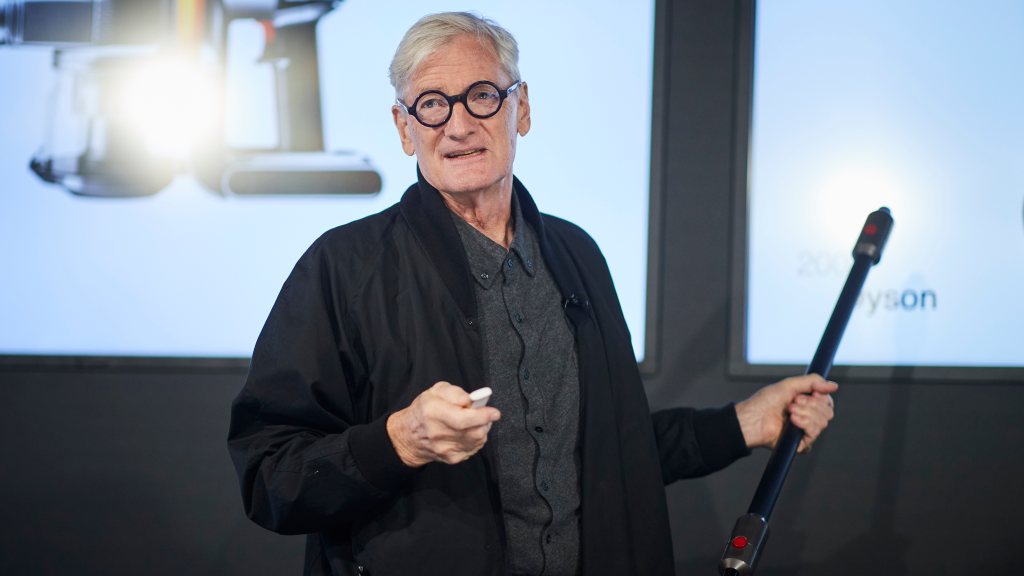

James Dyson Criticizes Rachel Reeves on Inheritance Tax Changes Impacting Family Businesses

Sir James Dyson has expressed strong disapproval over recent changes to inheritance tax proposed by Chancellor Rachel Reeves, labeling the alterations as an act of “vindictiveness” that threatens family businesses crucial to the employment of 14 million individuals.

In correspondence with The Times, the 77-year-old billionaire argued that Reeves’ measures would potentially “destroy” family businesses and could lead to significant losses in tax revenue for the government.

The modifications, set to take effect in April of next year, will revoke the existing exemptions for farms and family-operated businesses concerning inheritance tax. According to forecasts from the Treasury, this measure is expected to generate an additional £500 million annually by 2030.

Under the new provisions, business property relief and agricultural property relief will be capped at £1 million, and any assets exceeding this threshold will be taxed at a rate of 20 percent. Notably, this adjusted rate is half of the typical 40 percent levied on other estates, with tax payments allowably stretched over a decade.

In defense of these changes, the Treasury has argued that the actual tax relief for farming couples is closer to £3 million, asserting that only a small number of estates will encounter the new tax obligations.

Economic analysts have indicated that eliminating the broad relief could discourage wealthy individuals from purchasing agricultural properties as a means of tax evasion.

Dyson, whose fortune is estimated at £20.8 billion and who contributes £103 million in taxes annually, possesses considerable farmland across Lincolnshire, Oxfordshire, Gloucestershire, and Somerset.

He pointed out that among the top 100 taxpayers in the UK, 60 are owners of family-run businesses, collectively contributing £3 billion in taxes while employing 14 million individuals and supporting vital public services.

“Rachel Reeves’ budget threatens to strip away family businesses through a confiscation of 20 percent upon every generational transfer,” Dyson stated, emphasizing that the imposed rate is grounded not on actual assets but rather on perceived future profits.

He further stated, “This means that the effective rate could escalate to 40 percent, as families would need to pay this tax through dividends, which are also subject to further taxation. In essence, it is British family businesses that bear the brunt, while private equity and publicly listed companies remain untouched. What motivates this punitive approach towards British families?”

Dyson warned that Reeves’ actions would not only devastate family-run enterprises but also eliminate a significant source of tax income, all for a projected yield of just £500 million by 2030. “She is jeopardizing the very source of economic growth,” he remarked.

Reeves, defending her proposed tax increases, stated that the aim is to place the public finances “on a firm footing.”

As reported, 40 percent of agricultural property relief benefits are currently allocated to merely 7 percent of estates, which Reeves highlighted in her comments to the BBC, arguing that such distributions are neither equitable nor sustainable.

Last week, she also announced plans to reverse certain tax rule changes affecting non-domiciled residents set to commence on April 6.

Recent data from analytics firm New World Wealth shows that Britain experienced a net loss of 10,800 millionaires due to emigration last year, marking a 157 percent increase compared to 2023, predominantly towards countries like Italy and Switzerland.

In light of this ongoing trend, Reeves stated her intention to expand the temporary repatriation facility to three years, enabling non-domiciled individuals to transfer funds into the UK with limited tax implications.

“We are adjusting aspects of how extremely wealthy foreign individuals are taxed,” she explained. “The adjustments provide for a temporary repatriation mechanism that allows incoming funds without imposing harsh tax rates.”

Post Comment