How Corporate Leaders Are Embracing Donald Trump’s New Era

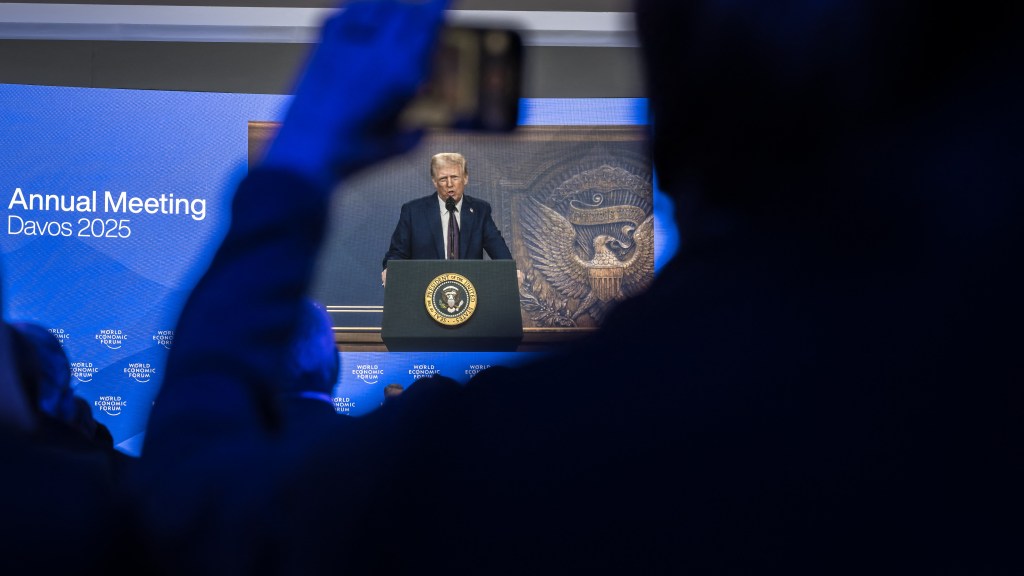

On the day before the conclusion of the World Economic Forum, Donald Trump reached out to top corporate leaders and political figures, marking a significant moment during a week that was heavily influenced by the newly inaugurated president’s priorities from afar.

Trump’s virtual participation, which was met with mixed reactions—including tepid applause and laughter at some of his remarks—occurred in a bustling Congress Hall filled with executives from major firms like Bank of America, Santander, Total Energy, and Blackstone.

Despite speculation about his potential physical appearance at the event, Trump opted not to attend, much to the disappointment of some attendees. “It feels like waiting for Godot,” remarked one delegate prior to Trump’s address.

However, for many of the nearly 3,000 attendees, his absence was secondary. Business leaders vocally supported Trump’s vision for a prosperous future defined by a revitalizing economy, global tariffs, and efforts to negotiate peace between Russia and Ukraine.

Lloyd Blankfein, the former CEO of Goldman Sachs, likened the atmosphere to “when Napoleon returned from exile in Elba,” referring to the warm reception given to the former president despite past criticisms.

The week kicked off with the inauguration of the 47th president, who was surrounded by influential figures in technology, finance, and industry. Many of these leaders swiftly traveled to Davos to share insights on the incoming administration’s approach.

James Quincey, CEO of Coca-Cola and attendee of the inauguration, expressed hope for Trump’s economic plans, noting his return to familiar habits, such as reinstating a Diet Coke button in the Oval Office.

Dara Khosrowshahi, Uber’s CEO and also present at the inauguration, highlighted the contrasting moods between Washington and Davos, saying, “The atmosphere in DC is one of optimism, while in Europe, it’s more about uncertainty.”

As the business community pivoted from “Bidenomics,” which aimed to bolster the U.S. economy through investments in green technologies, they now welcomed Trump’s declarations of “shock therapy,” which include rolling back regulations in the fossil fuel sector and aggressive immigration policies.

Vicki Hollub, president of Occidental Petroleum, advocated for stricter immigration controls during a WEF discussion, emphasizing the need for action against illegal migration.

Mario Greco, CEO of Zurich Insurance, remarked that Trump’s inauguration speech was particularly impactful, noting the clarity of his intentions.

One of Trump’s early announcements was the U.S. exit from the Paris Agreement on climate change, which he dismissed as ineffective.

Greco expressed skepticism about the Paris Agreement’s effectiveness, stating, “It has not met the expectations set for it; however, we are looking for alternative means to address necessary temperature reductions.”

As the political landscape shifted, insiders at the WEF noted a decrease in focus on topics like diversity, inclusion, and sustainability compared to previous years, with several advocates expressing disappointment at reduced speaking invitations.

The lead-up to Trump’s address included remarks from Argentina’s President Javier Milei, who proposed an “international alliance” that included Trump, Elon Musk, Hungary’s Viktor Orban, and Italy’s Giorgia Meloni.

Market optimism was reflected by the S&P 500 reaching new highs, Bitcoin exceeding $109,000, and US Treasury bonds rebounding after a rough start to the year amid concerns over the growing U.S. budget deficit.

Proponents of Trump’s policies highlighted growth data indicating the U.S. economy’s superior performance among the G7 nations, showcasing strong productivity. The International Monetary Fund recently revised its U.S. growth projections upward to 2.7% for 2024, in contrast with modest growth expectations for the eurozone and the UK.

Paul Gruenwald, chief economist at S&P Global Ratings, emphasized, “The U.S. economy is outperforming others, demonstrating resilience against high interest rates, maintained consumer spending, and robust corporate investment.”

Many corporate leaders, while discussing their outlooks publicly, refrained from addressing potential concerns surrounding an overheated economy that might result from Trump’s aggressive fiscal policies or labor shortages stemming from his deportation plans.

In private discussions among political and financial elites, there were candid conversations about the potential for price controls in response to inflationary pressures from Trump’s proposed measures. Attendees expressed concerns that Trump may further influence the Federal Reserve, particularly after he advocated for lower interest rates during his address.

Some CEOs voiced caution regarding the abandonment of green initiatives, like electric vehicle mandates. Bill Winters, CEO of Standard Chartered, underscored the importance of reducing reliance on fossil fuels, stating, “We need to transition away from fossil fuels while maintaining profitability.”

Post Comment