Afin Bank Secures UK Banking Licence, Aims to Serve African Diaspora

Afin Bank, a new digital bank focused on the African diaspora in the UK, is set to begin lending operations next year after obtaining a banking licence from UK financial regulators.

This bank joins a growing list of online lenders that have emerged recently, seeking to capture market share from established high street counterparts.

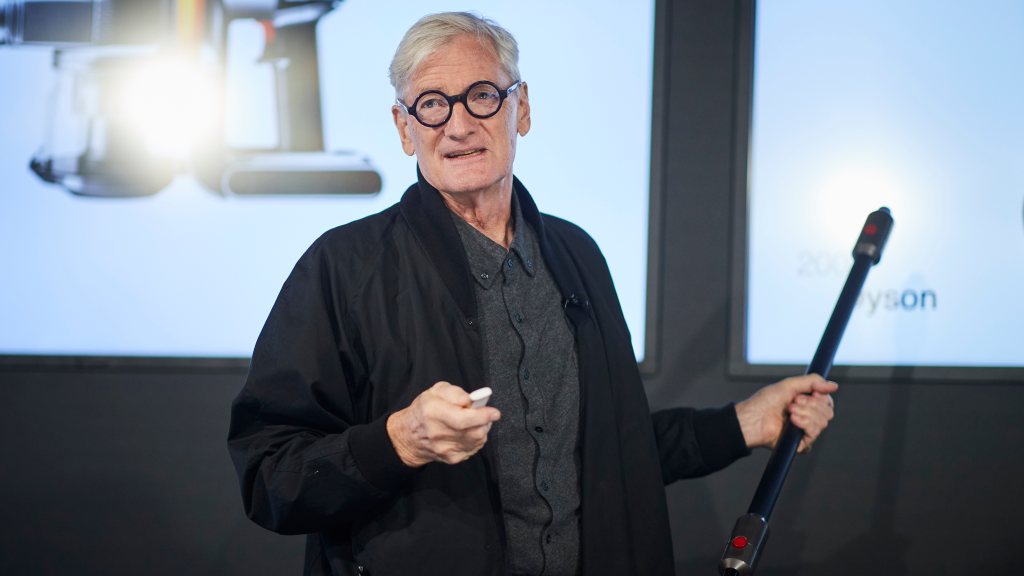

With a target demographic of approximately 1.5 million African nationals residing in the UK, Afin Bank intends to cater to a community it perceives as underserved by traditional banks. Majority-owned by WAICA Reinsurance Corporation from Sierra Leone, Afin Bank is led by Jason Oakley, a seasoned banker with nearly 20 years at the Royal Bank of Scotland, now known as NatWest, alongside senior roles at Metro Bank and the founding of Recognise Bank.

A significant market segment for Afin includes young African professionals who encounter difficulties obtaining mortgages from mainstream banks, particularly due to their short residency in the UK.

“Many face challenges establishing a credit history, leading to a prolonged rental period of two to three years,” Oakley noted.

Afin Bank plans to offer specialized products such as buy-to-let mortgages for affluent clients in Africa looking to invest in UK property markets, thus diversifying their investments and mitigating currency devaluation risks. Oakley emphasized that the bank will implement stringent due diligence procedures for overseas clients to prevent money laundering.

WAICA, which has operations across various African nations including Ghana, Nigeria, and Kenya, as well as Dubai, has pledged £62 million to support Afin Bank, with £23 million already allocated. WAICA holds just over 90% of Afin, with the remaining shares owned by the bank’s management team. The institution was previously known as All Africa Capital, which Oakley has been directing for the past two years.

The bank has received what is known as “authorisation with restrictions” from UK regulators—a provisional status that allows new banks a maximum of one year to finalize their business operations during which it can only accept £50,000 in deposits.

Other digital banks that have recently made an impact on the UK banking landscape include Starling Bank, Monzo, Atom, and Zopa Bank.

In July, Revolut—initially a foreign exchange and money transfer service—also gained “authorisation with restrictions” after a lengthy three-year process to secure its banking licence. This privately held fintech company, deemed a standout in the UK’s fintech sector, was valued at $45 billion after employees sold shares in August.

Post Comment